Framework 1 : Retention is an Ecosystem + T-Mobile Case Study

Retention is an Ecosystem - not a CRM tactic

🧠 What this is:

A diagnostic framework used by senior teams to surface and sequence the true drivers of retention and defection, before investing resources in the wrong solutions.

👤 Who it’s for:

Enterprise leaders carrying the retention number, CCOs, CMOs, and commercial heads, with cross-functional pressure.

📈 What it does:

Reveals hidden system failures in acquisition, product, service, pricing, and messaging, so you can align teams, reduce decision risk and drive impact.

Executive Summary

I often work with mid- and large-enterprise brands that view retention as the responsibility of the CRM Marketing function, which sits under the CMO or CCO.

CRM can and does make a significant impact.

I’ve seen this firsthand, helping enterprise teams generate 8-figure + incremental revenue through well-designed CRM programmes and by training practitioners at scale.

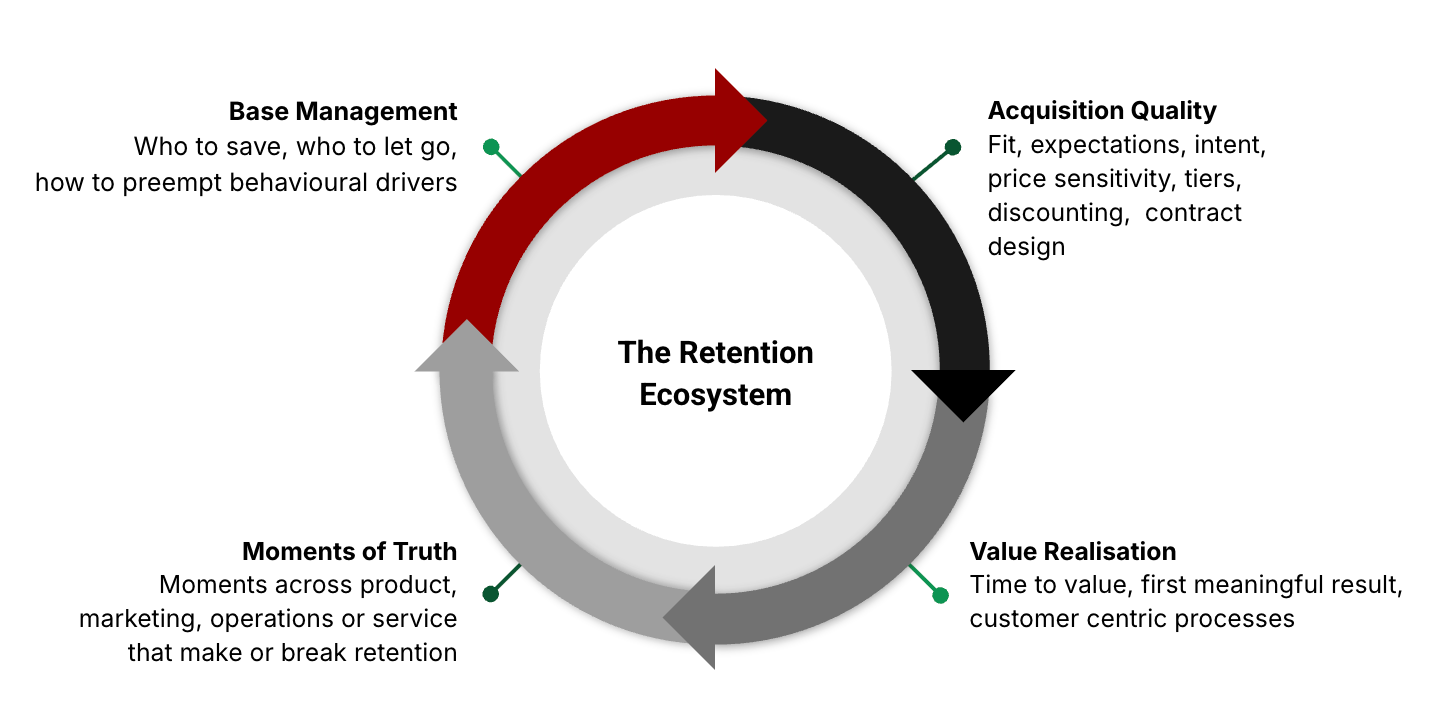

But retention is not driven by messaging alone; it is a function of how acquisition, commercial mechanics, product, value realisation, service, and lifecycle interact within the retention ecosystem.

CRM marketing and lifecycle sit inside the ecosystem; they do not define it

Acquisition quality sets the upper limit on retention performance.

Different failures drive early-life and in-life churn.

Moments of Truth reveal where ownership breaks down across teams, and some MoT can be retention-defining.

Behavioural science, not a lack of messaging, explains most churn, which is why intelligent base management is so important.

Going deeper

The retention KPI is almost always owned by one ExCo leader, likely the CCO or CMO.

But the levers that drive retention sit under multiple ExCo members and span product, acquisition, service, pricing, operations, and lifecycle.

You don’t need a transformation.

You need to know where churn is coming from, what to fix first, and how to align your ExCo behind it.

Let's break down the ecosystem's components and articulate the boardroom reality.

1. Acquisition quality – who you acquire, how you price, and the tiers you offer have a big impact on retention.

If you acquire a lot of deal-hungry, uncommitted, low-value customers, they won't stick around very long.

Most businesses acquire based on a blended CAC, which maximises the volumes of low-value customers because, in any given market, there are always more low-value customers than high-value customers.

While it's easy to say, "Let's focus on acquiring high-value customers,", with pressure to meet subscriber targets, this can be a delicate balancing act. The goal here is to manage acquisitions to ensure you still hit targets, while optimising the value mix.

Key things to watch out for:

Ensure you are calculating customer lifetime value correctly. Forrester claims 80% of brands are not, and, by the way, it's not a sum of historic spend.

You can read more on lifetime value here.

Ensure you have a differentiated CAC approach for different audience types based on lifetime value:

Lowest-value prospects: minimise CAC to maximise LTV packback.

Prospects with mid potential value = spend more to acquire, since LTV payback will be better.

Prospects with high potential value = you can spend the most to acquire these customers, and often you can (a) outspend competitors using a blended CAC for this cohort, (b) when you acquire them, they will be retained far longer because the fit is better.

If you are not doing this now, start with a small test budget, run it for a while (3-6mths), make sure you are acquiring better customers and the approach is working. Then you will be able to update acquisition volume targets, as the customers you obtain will be more profitable and more sticky. While there may be fewer of them for the same budget, overall profitability will be higher.

Acquisition quality is also about commercial mechanics: pricing, tiers, discounting, contract lengths, and renewal mechanics actively shape retention behaviour, not just the acquisition mix. For example:

Plan length signals commitment and is an essential aspect of treatment (more committed customers can be prioritised for differentiated service).

Discounting front loads churn risk, especially if pricing is not stepped up in subsequent billing periods.

Renewal mechanics (auto-renew vs frictionful renewal) create inertia or resentment.

Monthly vs fixed-term plans, auto-renewal, and notice periods alter the customer’s evaluation window, tolerance for short-term value gaps, and the emotional cost of cancellation.

Commercial mechanics are not just “commercial”; they are a fundamental retention driver. Commercial mechanics are also critical for base management (more on that later).

2. Value realisation and the different system failures that drive early-life and in-life churn

Many companies believe they provide value rather than delivering a ‘thing’.

The problem is that when brands believe they provide value, they can come to view their products or services as gifts bestowed upon customers.

This can lead to customer initiatives focused on managing customer relationships for the benefit of the business, and result in actions like:

Forcing customers to adapt to your processes

Forcing customers to engage in your preferred channels

Forcing customers to do things that benefit only your business

Poor levels of customer support, e.g. poor chatbots or long wait times

Messaging focused on what businesses want from customers, with little personalised alignment to customer needs or preferences.

These factors can negatively impact customer retention across all lifecycle stages.

In early life, the impact becomes more pronounced and can lead customers to question whether the brand is truly a fit for them.

For in-life customers, it can generate a feeling of being undervalued (more on that later).

And it is again where the retention ecosystem breaks down, because responsibility for these policies often rests with an Exco member who does not bear responsibility for the retention number.

You can go deeper into value realisation here and learn how to build a successful early-life strategy here.

3. Moments of Truth expose where ownership breaks down across teams and can be retention-defining

Many customer experience projects fail, money is wasted, and teams are disbanded, because brands set out to optimise the entire experience.

Driving retention-led growth is not about optimising the entire customer experience.

In any recurring-revenue business, key moments occur during the first 90 days: when usage drops, when the customer experiences a significant service issue, or when they enter the cancellation journey. All of these life stages include ‘moments of truth’.

In this video, you can learn how to identify moments of truth, assess their impact vs. prevalence, and prioritise optimisation efforts to drive retention-led growth.

4. Behavioural science explains most churn, and base management mitigates it

Across all subscription and recurring revenue sectors, there are four standard behavioural drivers of churn. Each has varying degrees of importance depending on the subscription or recurring revenue sector you operate within, but all can be effectively mitigated with strong base management:

1. “I don’t feel the value fast enough to keep using this.” If the customer's job is not solved quickly and relatively effortlessly, they may never fully engage. This is particularly true for B2B SaaS, streaming, meal kits, and similar categories.

Mitigation - Identify the actions retained customers take in early life and focus product/CRM/service-based management efforts on ensuring new customers take those actions. Customers need an early reward for low effort.

2. “I’m paying for something I don’t use; I feel guilty.” All subscriptions are charged on a recurrent basis. Gyms, Netflix, meal kits, vitamins, meditation apps, gaming passes, and premium newsletters all follow the same pattern: when usage drops, guilt rises, and churn becomes inevitable.

Mitigation - Hyper-personalisation, alignment with customer values, and delivering value beyond the core service are practical, foundational base management techniques that help reduce guilt when usage declines and/or mitigate usage reduction entirely.

3. “The novelty has worn off, I’m not excited anymore.” Human brains love novelty, but we also habituate quickly. Streaming libraries, fitness content, subscription boxes, betting apps, mobile games, learning tools and meal kits all often experience novelty fade.

Mitigation: Put simply, this is about ensuring the offer is fresh, engagement is maintained, values are aligned, and the customer is encouraged to explore content or features they have not used before. The key is to define responsibility for reducing novelty fade among stakeholders across product, marketing, service, and operations. Working groups work well here. If you don't put focus on novelty fade, the driving awareness product's new content or features can be forgotten or assumed.

4. “I don't feel valued.” or “My time is not valued” Many brands intentionally or unintentionally create friction in customer service, cancellation processes, plan changes, pausing, downgrading, or with price hikes. Most of the time, this happens because policies and approaches are business-centric, leaving customers feeling undervalued or unappreciated. In longer-term contracts, such as those common in telecommunications, this creates inertia churn: customers continue paying while emotionally disengaging and planning to leave at the next opportunity.

Mitigation: The simplest and most effective way to make a customer feel valued is to focus on and optimise those service moments of truth, as this is where this behavioural driver is often most pronounced. Loyalty programs can also play a role here, as can surprise-and-delight gifts or exclusive, personalised, valued offers for tenured customers, as well as in contract promotions that offer price reductions vs headline prices while extending customer tenure.

The reason retention is breaking

Retention breaks when one or more of the factors in the ecosystem are not working.

But often the real driver is a misalignment across teams: incentives, KPIs, and success metrics are not aligned around driving retention-led growth.

Acquisition teams optimised on volume, not LTV

Product teams optimised on delivery, not retention outcomes

Service teams optimised on cost, not retention impact

CRM optimised on clicks, not base management outcomes

This is a system failure, not a people failure and requires a holistic approach to retention across functions.

This is where working groups come in. I wrote about this here.

How to use this framework:

Use it when retention performance has plateaued or is declining

Use it to diagnose where retention is breaking before deciding what to fix. This video, will help with that too.

Use it to align product, acquisition, and lifecycle around the same priorities

Things usually go wrong when teams jump to tactics before agreeing on the system failures - this is where understanding how the retention ecosystem applies to your business and leveraging my board pack system can drive rapid alignment and focus. See here.

Case Study: T-Mobile USA Transformation

One of the best examples of a brand that transformed its business using the principles outlined in this framework is T-Mobile USA.

Some of the initiatives they implemented included:

Improving Acquisition Quality

A focus on acquiring for value

Ensuring advertising included all taxes and fees

Simplifying plans, e.g. unlimited text and calling, with data as the only variable element

Identifying that customers realise value

Offering family plans

Making upgrades easier

Offering free music streaming

Offering free in-flight calling and texting with Gogo

Allowing for the automatic rollover of unused data

Introducing a welcome program directly from the person who sold the product to the customer

Optimising moments of truth & understanding behavioural drivers

Creating service centres organised into teams of experts, able to solve problems in one conversation

Contacting all detractors (tracked via NPS) to work out what was wrong and to fix the problem for the customer and others

Giving employees latitude to delight customers

Simplifying the rewards program with no points breakage

T-Mobile truly understand the entire retention ecosystem.

They made substantial changes to acquisition, recognised that customers realise value, placed deep emphasis on optimising moments of truth, and demonstrated a deep understanding of human behaviour.

You might think all these freebies and customer-centric changes must have hurt T-Mobile’s P&L, but the reality is that a focus on retention led to growth that absolutely transformed the business.

Between 2013 and 2019, T-Mobile's cumulative shareholder return sat at 133%, the highest in the industry in the US, and the customer base tripled from around 35m to 90m customers because:

Customers did not want to leave

Referral rates improved

This supported acquisition efficiency

Upsell improved

And cost to serve reduced because tenured customers require less support

Viewing retention as an ecosystem has catapulted T-Mobile from the 4th-largest carrier in the US (with the worst reputation in the industry) to number 2 today (with the best reputation).

—--

If retention is a current priority, this is the type of system-level work I help senior teams with.

I run a Retention Prioritisation Sprint for senior teams who carry the number but don’t control the levers.

Independent retention diagnostic

Clear prioritisation logic

Board-defensible roadmap

→ I work with one client at a time.

→ If retention is high-stakes for you this quarter, book a call or email me [email protected]

Thanks for reading.

Tom

P.S. What did you think of this episode? |

P.P.S If you know someone who would find this helpful, feel free to forward the link.

Reply