Episode 59 - CRM Marketing Performance Benchmarks

Did someone forward this to you? If so, click to subscribe

Welcome to episode 59 of The Retention Blueprint!

In this current series, we are diving into what makes great CRM Marketing. We have covered CRM Marketing heuristics, short cuts that drive action (epi 55), moments of truth (epi 56), the real role of segmentation and personalisation (epi 57) and measurement and testing (epi 58). You can catch up on previous episodes here.

Often I am asked what good performance looks like for different communication channels at different stages in the lifecycle across different verticals. So this episode dives into exactly that, looking at CRM Marketing benchmarks.

📰 Top Story: CRM Marketing Benchmarks

I have reviewed multiple resources (listed below) to create a framework for identifying what effective CRM marketing looks like across different communication channels and stages in the customer lifecycle, as well as across various verticals.

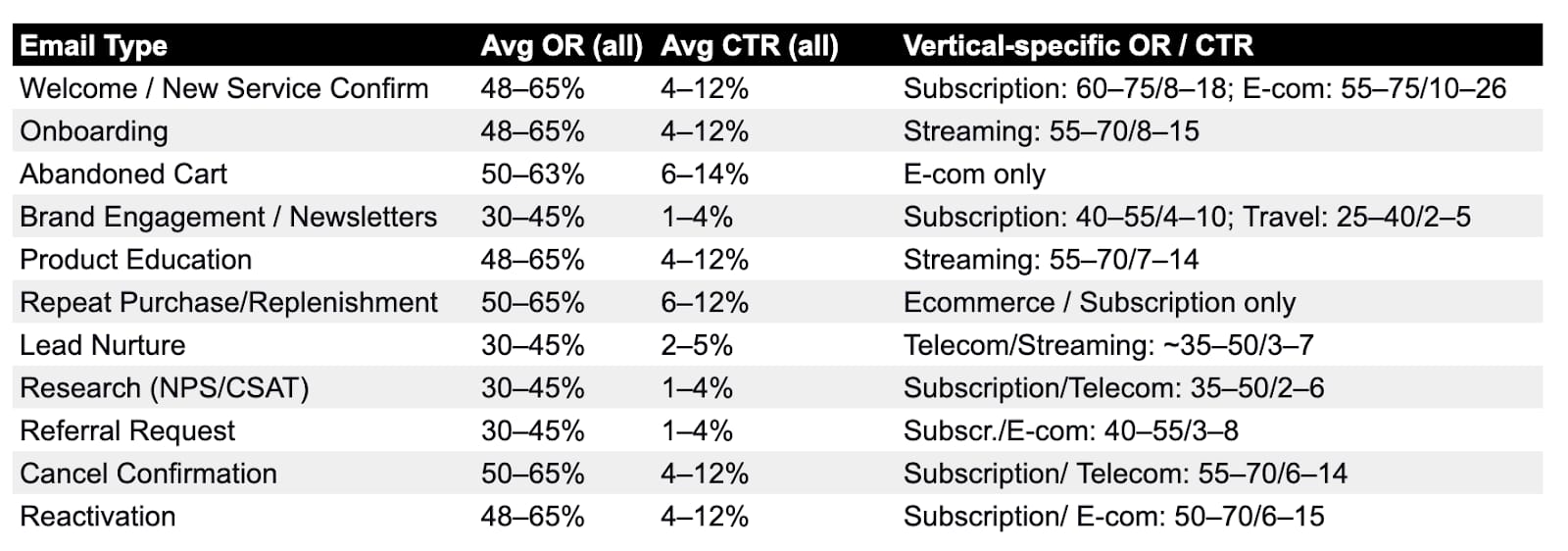

The metrics discussed include open rates and click-through rates for welcome, onboarding, in-life, cancellation, reactivation, and broadcast campaigns across various sectors, including subscription, e-commerce, travel (including airlines), telecom, iGaming, media, and hospitality.

As we explored in episode 58, open rates have become significantly less reliable since Apple introduced Mail Privacy Protection (MPP), making it challenging to track on Apple. Nevertheless, if your email isn’t opened, your message won’t have the same impact.

However, your primary focus should be on the behaviour you want to drive - whether that’s product engagement, cross-selling, upselling, loyalty program sign-ups, or reactivation. That is what you should measure effectiveness against, as comparing against a control group allows you to be confident in your impact.

It’s important to note that outcome metrics specific to your brand, vertical, customer segment, and target behaviour are unique. Therefore, my advice is always to assess how your CRM marketing activities improve in relation to the north star metric for that communication over time. If you do this, your impact will grow.

We discussed techniques for accelerating CRM marketing performance in episode 58. Despite the unreliability of open rates or indeed click-thru rates, they are often shared, discussed, and used as indicators of performance. I hope you find this resource helpful in evaluating the impact of your activities against these baseline engagement metrics, which ultimately contribute to the key metrics you aim to drive. After all, without an open or a click, you won’t achieve the desired uplift in the behaviour your communication seeks to influence.

Email Marketing

Welcome / New Service Confirmation

Onboarding Emails

Automated average: OR ≈ 48–65%, CTR ≈ 4–12%

Streaming: 55–70% OR, 8–15% CTR

Telecom: 45–60% OR, 5–10% CTR

Subscription box: 60–75% OR, 10–18% CTR

iGaming: 50–65% OR, 8–14% CTR

E‑commerce: 55–70% OR, 8–16% CTR

Travel/Airlines: 45–60% OR, 6–12% CTR

Abandoned Cart Emails

Brand Engagement / Newsletter Emails

Product Education Emails

Repeat Purchase / Replenishment Emails

E‑commerce & Subscription: 50–65% OR, 6–12% CTR

Lead Nurture Emails

Research (NPS/CSAT) Emails

Survey emails average: OR ≈ 30–45%, CTR ≈ 1–4%

Subscription boxes & telecom: ~35–50% OR, 2–6% CTR

Referral Request Emails

All industries (campaigns): OR ≈ 30–45%, CTR ≈ 1–4%

E‑commerce & subscription: ~40–55% OR, 3–8% CTR

Cancel Confirmation Emails

Subscription & telecom: ~55–70% OR, 6–14% CTR

Reactivation Emails

Triggered, all industries: OR ≈ 48–65%, CTR ≈ 4–12%

Subscription & e‑commerce: ~50–70% OR, 6–15% CTR

Summary Table

Key Notes:

Automated flows (welcome, cart, triggers) consistently outperform campaigns by ~10–15pp in OR and ~3–8pp in CTR. This is because they are timing and context aware. See episode 57 for details on the real role of personalisation.

Welcome emails top the charts: OR up to ~80% in some cases. Do not make the first email you send a receipt. Make it special, welcoming, inviting and relevant to the next step.

Newsletters typically see lower engagement: OR ~30–45%, CTR ~1–4%

Travel vertical lags overall: OR ~22–40%, CTR ~2–5%.

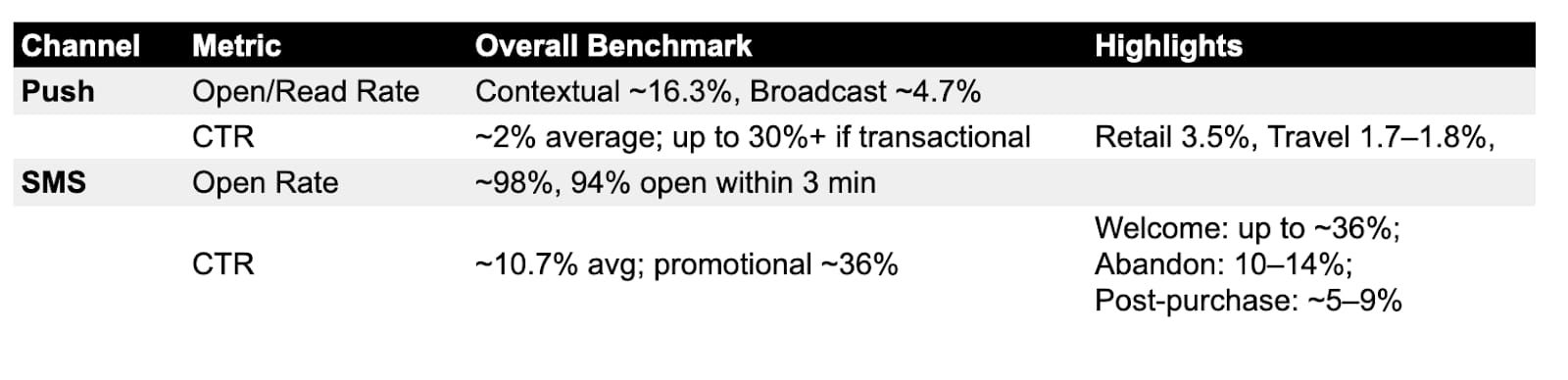

Push Notifications (Mobile)

Read/Open Rate

Contextual/triggers: ~16.3% open rate

Generic broadcasts: ~4.7%

CTR (Click-Through Rate)

All industries average: ~2% CTR; targeted/transactional pushes can hit 30%+

Average CTR by device types: iOS 3.4%, Android 4.6%

By vertical:

SMS Messaging

Open/Read Rates

Overall SMS open rate: ~98%

Timing note: 94% of opens occur within 3 minutes

CTR (Click-Through Rate)

Welcome messages:

Summary Table

Key Notes

Push notifications: Contextual triggers drive significantly higher engagement than generic blasts - CTR can exceed 30% in targeted contexts.

SMS: Near-universal visibility (98% open rate); CTR averages ~11%, but can spike dramatically for timely and relevant messages.

Vertical nuance: E-commerce, retail, and service sectors often outperform averages on both push and SMS; travel and hospitality lag slightly.

Final Thoughts

I hope you have found todays episode to be a useful resource for assessing engagement metrics of your CRM Marketing activity.

You can delve deeper by reviewing the references below.

Remember if you ever want to refer back to this episode or any other episode, you can view them all in the archive.

Until next week,

Tom

References

Klaviyo Email marketing benchmarks 2025 : open rates, click rates and conversion rates by industry

Mailmodo: Welcome email stats

AI Performance Marketing Agency: OR & CTR benchmarks

Moengage: Push notification metrics measuring ROI for maximum impact:

Texla: Your 2025 guide to SMS marketing metrics

Gravitec - Seven Push Notifications Performance Metrics to Measure Success of Your Push Campaign

Airships 2025 Mobile Benchmarks Engagement report

P.S. What did you think of this episode? |

Do you need help with Customer Retention?

When you are ready, contact me to discuss consulting, my fast-track retention accelerator, courses, and training. Or if you are interested in sponsoring this newsletter, get in touch via [email protected]

Reply